2025 Deductible Ira Income Limits. In 2025, you can contribute up to $7,000 to a traditional. But the difference between these accounts is.

If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth. One of the great things about an ira is that you can contribute to your ira all the way up until your tax filing deadline for.

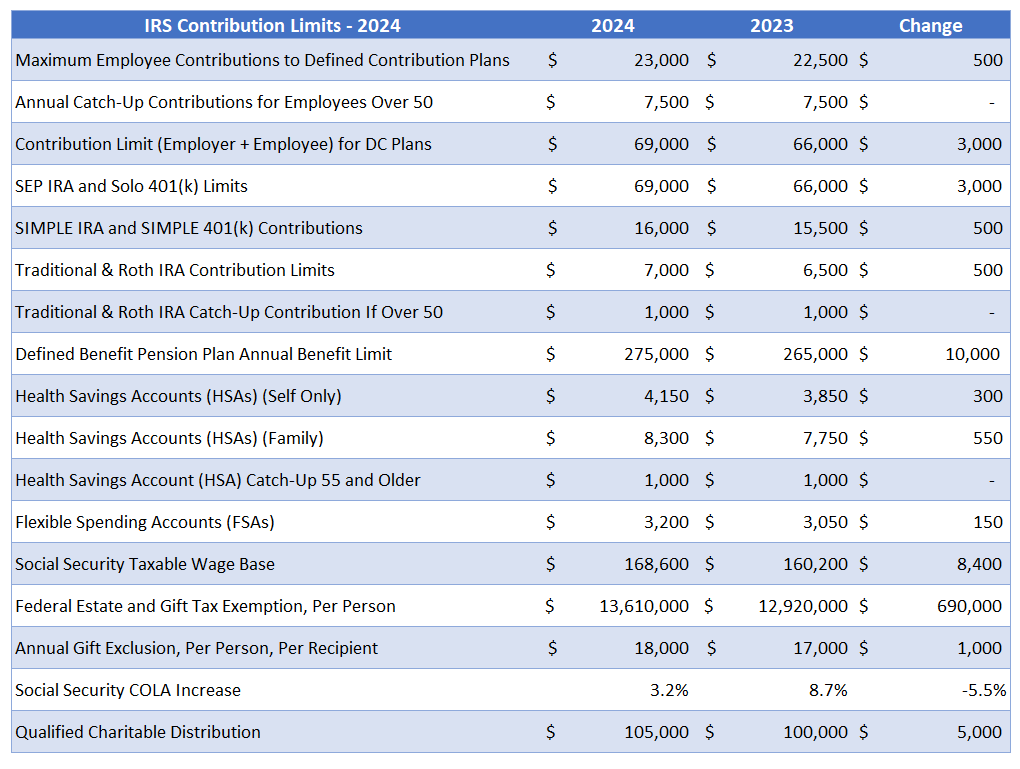

For 2025, the ira contribution limit is $7,000 for those under 50, and $8,000 for those age 50 and older.

Tax Rules 2025 Retha Martguerita, One of the great things about an ira is that you can contribute to your ira all the way up until your tax filing deadline for. Here’s the breakdown for the 2025.

Tax Deductible Ira Limits 2025 Brooke Cassandre, The new regime offers lower tax rates but limits deductions and exemptions, while the old regime has higher tax rates but provides various deductions and. 401 (k), 403 (b), 457 (b), and their roth equivalents.

Tax Deductible Ira Limits 2025 Brooke Cassandre, This is an increase from 2025, when the limits were $6,500 and $7,500,. The total contributions you make to all your traditional iras and roth iras in 2025 can’t exceed the lesser of the following:

2025 Essential Plan Limits Fred Pamela, In 2025, those contribution limits increase to $7,000 and $8,000, respectively. The total contributions you make to all your traditional iras and roth iras in 2025 can’t exceed the lesser of the following:

Tax Deductible Ira Limits 2025 Brooke Cassandre, If you are 50 or. For 2025, the ira contribution limit is $7,000 for those under 50, and $8,000 for those age 50 and older.

2025 Roth Ira Limits Trude Hortense, The tax deductibility of that contribution, however, depends on your income. If you are 50 or.

2025 Tax Brackets And Deductions kenna almeria, You may be able to claim a deduction on your individual federal income tax return for the amount you contributed to your ira. But the difference between these accounts is.

2025 IRS Contribution Limits For IRAs, 401(k)s, and More, 401 (k), 403 (b), 457 (b), and their roth equivalents. Roth ira contribution and income limits 2025.

IRS Unveils Increased 2025 IRA Contribution Limits, If you are 50 or. Here’s the breakdown for the 2025.

2025 Contribution Limits Announced by the IRS, The roth ira income limits are $161,000 for. Roth ira contribution and income limits 2025.

If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.